Find the Present Value That Will Grow to

In ordinary case the formula is. Present Value of Growing Perpetuity Formula PV dfracPMTi-g PV Present Value.

Present Value Of Perpetuity How To Calculate It Examples

C Future sum.

. PVfrac C 1in P V 1 inC. Find the present value that will grow to 25000 dollars if interest is 32 compounded quarterly for 11 quarters. Find the present value that will grow to 23000 if interest is 5 compounded quarterly for 19 quarters.

Annual Interest Rate. Annual Interest Rate How many years. Enter the present value discount rate.

The Present Value Formula. N Number of periods. The general solution comes in this formula.

The present value formula is PVFV 1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. PMT Periodic payment. PMT Periodic payment.

Total Value 206103 Total Interest 106103. Used compound interest formula. Looking for more calculators.

Select either Months or Years and enter the corresponding number of periods to calculate present value for. A popular concept in finance is the idea of net present value more commonly known as NPV. Present Value of a Growing Annuity Formula.

I Discount rate. Therefore present value is 25468 Ans Answer link. A growing perpetuity is a series of periodic payments that grow at a proportionate rate and.

Enter the future lump sum you would like to calculate present value for. PV Present Value. Put everything in the formula.

The future value sum FV. Number of Years to Grow. Based on Principal Amount of 1000 at an interest rate of 75 over 10 years.

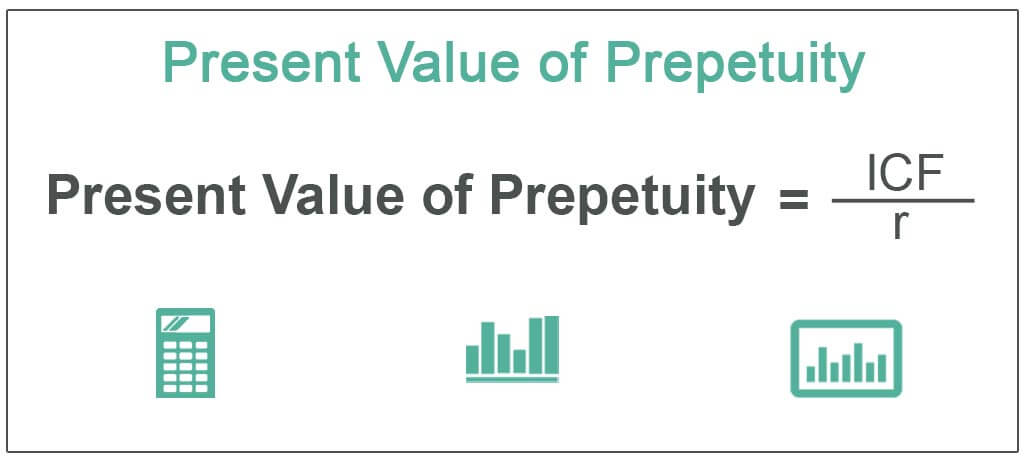

Investment A wins over Investment B by. The calculation for the present value of growing perpetuity formula is the cash flow of the first period divided by the difference between the discount and growth rates. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate.

Try our savings calculator to determine how quickly you will be able to accumlate savings. 1i -n i-g PV PMT ig11 gn 1in. Number of Years to Grow.

- If Interest rate per period Growing payment rate then. The present Find the present value that will grow to 24000 if interest is 3 compounded quarterly for 14 quarters. Do you have a.

The present value is the total amount that a future amount of money is worth right now. Click the Calculate Present Value button. Present Value of Growing Annuity PVGOA or PVGDA is calculated depending on the annuity type.

The algorithm behind this present value of growing annuity calculator applies the equations detailed here. The present value formula for annual or any period really interest. The present value is Round to.

G Growth rate. P V P M T 1 1 g n 1 i n i g. Find the present value that will grow to 29000 if interest is 9 compounded quarterly for 16 quarters.

This is a special instance of a present value calculation where payments 0. Present Value Principal Amount. Select the applicable discounting interval.

Number of time periods years t which is n in the formula. Plugged that number into the compound interest present value calculator to figure out what that one time payment today would need to be. P V C 1 i n.

The present value is Round to the nearest cent as needed The present value is Round to the nearest cent as needed. I Interest rate where 1 is 100. Round to the nearest cent as needed.

Calculate the present value investment for a future value lump sum return based on a constant interest rate per period and compounding. Times dfrac 1 - 1gn. Get 1-on-1 help from an expert tutor now.

Find the present value that will grow to 24000 if interest is 5 compounded quarterly for 10 quarters The present value is SD Round to the nearest cent as needed. 10 20160705 2209 40 years old level An engineer Very Purpose of use calculate mega millions lottery 400 milions in 30 years to present value. Notice that the only variable difference here is the compounding interval.

PVGOA PAr gr 1 1 gr1 rNP. Find the present value that will grow to 21000 if interest is 2 compounded quarterly for 20 quarters. I Discount rate.

F V P V 1 RT or P V F V 1 RT 30000 1 001511 30000 101511 25468. Solution for Find the present value that will grow to S29000 if interest is 5 compounded quarterly for 13 quarters. Algebra questions and answers.

G Growth rate. The present value of a growing perpetuity formula is the cash flow after the first period divided by the difference between the discount rate and the growth rate. Input these numbers in the present value calculator for the PV calculation.

Present Value Of A Growing Annuity Formula With Calculator

No comments for "Find the Present Value That Will Grow to"

Post a Comment